4617 Hidden Glen Drive, Antioch, California 94531, Antioch, - bed, bath

ACTIVE UNDER CONTRACT$799,000

4617 Hidden Glen Drive, Antioch, California 94531

4Beds

3Baths

2,359Sqft

9,496Lot

Year Built

2012

Close

-

List price

$799K

Original List price

$799K

Price/Sqft

-

HOA

-

Days on market

-

Sold On

-

MLS number

FR25095098

Home ConditionGood

Features

Good View: Hills, Neighborhood

Patio

ViewHills, Neighborhood

About this home

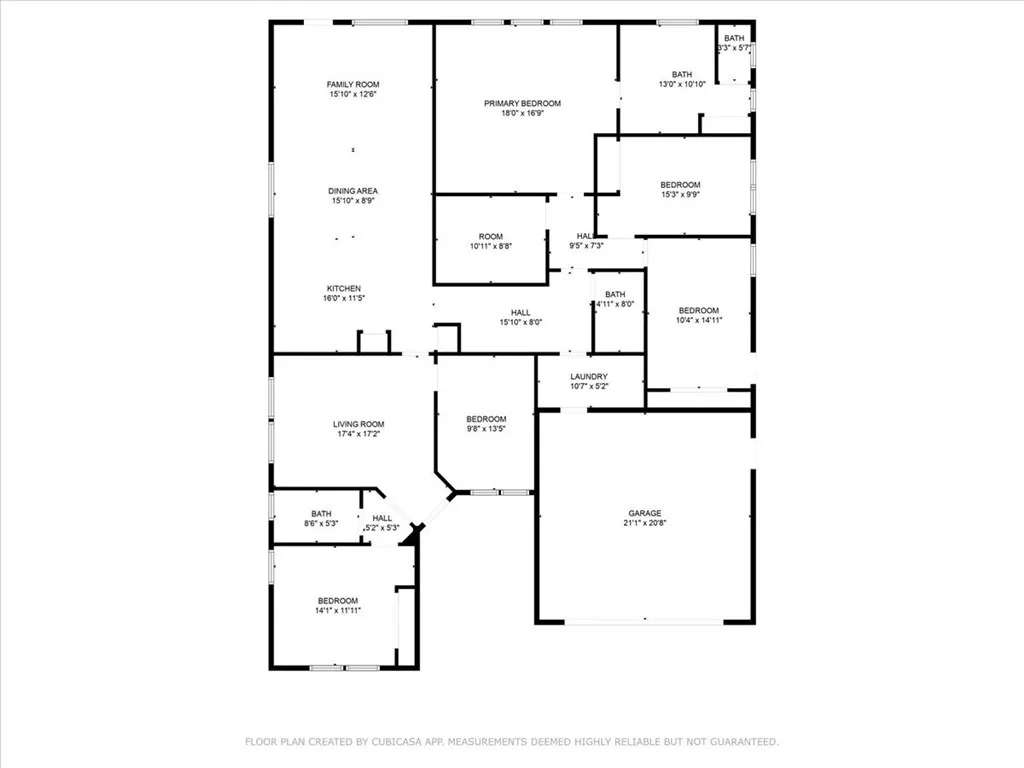

Calling all interested in the licensed care home industry! Located in quiet Antioch Calif neighborhood, this operational (RCFE) licensed elder care property is ready for it's new owner. Seller has been proactive in property upkeep and is well maintained; with a very positive reputation with the community; making this a wonderful opportunity to add to your portfolio in the bustling Contra Costa County. Home has been ADA renovated with numerous updates, including not 1, but 2 complete roll in showers, widened doors, halls, fire door, entry door slight ramp, with 4 4 spacious bedrooms and 2.5 baths, beautiful covered patio in the backyard.An additional bonus room can be utilized for caregiver or other purposes. Call today for more information

Nearby schools

3/10

Carmen Dragon Elementary School

Public,•K-6•0.8mi

3/10

Grant Elementary School

Public,•K-6•0.8mi

1/10

Black Diamond Middle School

Public,•7-8•0.9mi

5/10

Deer Valley High School

Public,•9-12•1.7mi

Price History

Date

Event

Price

04/30/25

Listing

$799,000

Neighborhood Comparison

| Subject | Average Home | Neighbourhood Ranking (126 Listings) | |

|---|---|---|---|

| Beds | 4 | 4 | 50% |

| Baths | 3 | 3 | 50% |

| Square foot | 2,359 | 2,226 | 61% |

| Lot Size | 9,496 | 6,725 | 82% |

| Price | $799K | $675K | 81% |

| Price per square foot | $339 | $313 | 62% |

| Built year | 2012 | 1997 | 78% |

| HOA | |||

| Days on market | 188 | 144 | 75% |

Condition Rating

Good

Built in 2012, this property falls within the 10-20 year age range for a 'Good' rating. The listing explicitly states 'proactive in property upkeep and is well maintained,' which is evident in the clean and functional appearance of the interiors. The ADA renovations, including roll-in showers, indicate recent updates for accessibility. While the kitchen features white appliances and traditional wood cabinets, and the bathrooms are practical rather than luxurious, all components appear to be in good working order with minimal wear and tear, making it move-in ready with no immediate renovation required.

Pros & Cons

Pros

Turnkey Business Opportunity: This property is an operational (RCFE) licensed elder care facility with a positive community reputation, offering a ready-to-go investment for those in the care home industry.

Extensive ADA Renovations: The home features significant ADA updates, including two roll-in showers, widened doors and halls, a fire door, and an entry ramp, making it highly accessible and compliant.

Well-Maintained & Newer Construction: Built in 2012 and described as well-maintained with proactive upkeep, suggesting a property in good condition with potentially lower immediate repair needs.

Versatile Layout with Bonus Room: With 4 spacious bedrooms, 2.5 baths, and an additional bonus room, the property offers flexibility for various uses, including accommodating a caregiver or other purposes.

Desirable Outdoor Space & Views: The property includes a beautiful covered patio in the backyard and offers pleasant 'Hills, Neighborhood' views, enhancing its appeal for residents and guests.

Cons

Listing Price Exceeds Estimated Value: The current listing price of $799,000 is approximately 4% higher than the estimated property value of $765,240.9, which may indicate it is slightly overpriced.

Niche Market Appeal: While a strength for a specific buyer, its specialized ADA renovations and current use as an RCFE home may limit its appeal to the general residential market, potentially narrowing the buyer pool.

Lack of Business Financials: The description highlights its status as an operational care home but does not provide crucial financial details (e.g., revenue, occupancy, profit) essential for an investor evaluating a business acquisition.